Through the National Homeownership Month, Nations Second step was permitting some body navigate renovation money and you will taking 100 % free tips for everyone amount regarding homeownership.

- /

- Information

- /

- Nations Step two Survey Finds out Americans Are Increasingly Prioritizing Renovations To help you Improve House Value

These types of courses mention the various particular financing and mortgage loans, financial relief alternatives, techniques to the creating and you will maintaining strong borrowing, plus the need for borrowing from the bank on the full monetary wellness

- Loans

Through the Federal Homeownership Month, Nations Step two is actually providing anyone browse recovery funding and you may bringing totally free info for everyone grade away from homeownership.

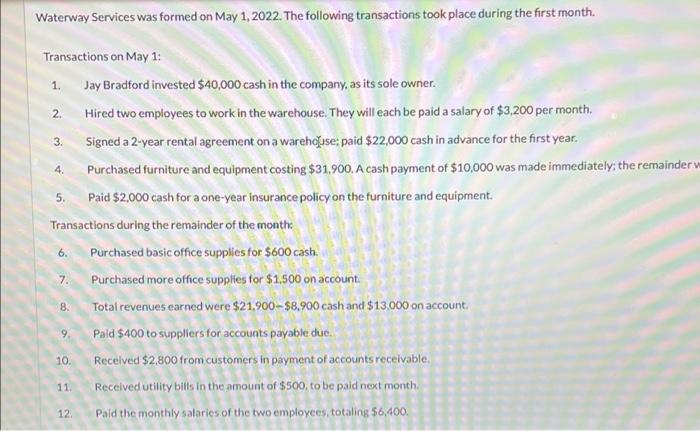

BIRMINGHAM, Ala., /CSRwire/ – Places Bank toward Wednesday announced the outcomes out of a different homeownership questionnaire you to definitely finds an increasing number of folks are renovations the residential property in order to boost their worth. Which happens while the homebuying industry remains very aggressive, with somebody choosing to improve the current homes instead of come across a new household.

June is Federal Homeownership Week, while the survey was conducted by the Regions Step two, this new bank’s no-cost monetary studies program one to suits people of all ages, no matter whether they lender having Countries. With regards to the survey, nearly 1 / 2 of (48%) off payday loans Glencoe direct payday loans U.S. property owners state they are attending generate reputation on their most recent household in order to raise the really worth regarding coming 12 months. It contour was right up eight % than the this time past year.

As well, younger home owners is actually really thinking about taking up a remodelling otherwise remodeling opportunity. Seventy percent of them between the chronilogical age of 18 and 34 can certainly make status compared with 52% of those age thirty five-54 and you may 40% of these decades 55+.

Just like the Us americans even more upgrade their houses, learning how to tap into house collateral to finance tactics are increasing. With regards to the survey, 42% getting acquainted with such capital choice compared to 38% out-of respondents who felt about realize about with the home’s collateral this past year.

Even in an aggressive housing marketplace, people still have a lot of possibilities, as well as through its home’s guarantee to support a restoration otherwise extension of their newest household, told you Michelle Walters, direct off Home loan Development within Regions Lender. The home loan and you may part-financial teams work at property owners that-on-that speak about its solutions and construct a financial roadmap towards the gaining their requirements. Should it be a renovation or an alternate family purchase we find this is advantageous consult an economic elite group and you can pick your options that will be best for your needs.

These types of programmes speak about the many particular funds and you can mortgages, mortgage recovery alternatives, techniques into the establishing and you can keeping good borrowing, as well as the dependence on credit for the full monetary fitness

- Clients need to the near future; almost one in around three (30%) propose to get a house within the next 12 months.

- Earnings are the biggest traps so you’re able to homeownership. Thirty-one percent quoted selecting a reasonable household plus one 30% detailed saving sufficient currency to possess a deposit while the greatest economic barriers. From participants old 18-34, 41% cited shopping for a reasonable domestic and you may 39% listed saving enough currency to have a deposit since their most useful barriers.

- Forty-five per cent out-of Americans become familiar with the general homebuying processes. Nonetheless they getting more experienced from the antique mortgages (45%) than authorities supported mortgages (36%) or earliest-big date homebuyer software (30%).

Due to the fact individuals policy for and build dream residential property, coming up with the new devices and you may paint may be the safest part of the techniques. Selecting the most appropriate resource options to help make their eyes a beneficial fact is somewhat alot more delicate to help you browse, told you Joye Hehn, Second step financial degree director for Nations. Nations try invested in providing 100 % free products and you can information which can let book homebuyers and you will people from the economic conclusion that suit their demands and you may specifications.

Included in Federal Homeownership Week, Places Lender is reflecting free tips that are available seasons-bullet to aid people and you can homeowners understand and you can navigate the the inner workings regarding home ownership

Self-moving Next step courses try accessible thru a smart phone, pill otherwise pc. As well, within Regions’ A week Webinar Series, anyone is register for the next lesson out-of The Path to Homeownership,’ which dives to the dangers, obligations and benefits that are included with homeownership. A complete plan can be obtained right here, and you will the fresh new schedules are additional frequently.

These programmes discuss the many variety of finance and mortgages, home loan relief selection, techniques towards the installing and you may keeping good credit, together with importance of borrowing from the bank to the total monetary wellness

- Do a renovation Budget: Having an intensive funds is essential for all the redesign. Possess numerous builders bid on a job before choosing you to, then focus on new builder in order to budget material, work, and extra can cost you such as for instance it permits. Usually booked a supplementary ten% for costs overruns (e.grams., unexpected fees and you may expenses).