This post is exposed to an intensive reality-examining process. Our elite reality-checkers ensure post guidance facing top offer, credible writers, and you can specialists in the field.

I receive settlement throughout the products and services said inside tale, however the feedback certainly are the author’s ownpensation can get effect in which offers come. We have perhaps not incorporated most of the available circumstances otherwise even offers. Find out more about exactly how we profit and you will our article policies.

When you yourself have debt, it does feel you’ll never be able to do anything financially once more – no less than up to you reduced the duty.

not, that is not constantly possible. Actually, you can buy property in debt. First time family visitors debt consolidation try possible, even although you believe you could have excessively debt. An important is in focusing on how debt consolidation functions and its own affect your chances of delivering accepted having home financing.

Here is what you need to know regarding to shop for an inexpensive domestic and the ways to score that loan when you have obligations already.

In some cases, the interest rate you have made to your home financing is leaner than just just what you will notice together with other types of loans. That’s because your property protects the borrowed funds, and certainly will feel repossessed if you prevent to make money. For most customers, it can feel like smart to roll the its personal debt into a mortgage.

Although not, it is not given that straightforward as you imagine. Very first, lenders commonly planning mortgage you extra money versus residence is worthy of. Instead, you will need a more impressive down-payment so you’re able to combine some of your own loans for the a home loan.

Like, if you would like pick a house you to definitely can cost you $180,000, their home loan company might only become willing to mortgage you upwards to help you 97 % of one’s speed, otherwise $174,600. To satisfy you to definitely minimum, you desire a deposit out of $5,400. Say you have got $ten,000 you could potentially put down. You have room enough so you can combine $cuatro,600 into your home loan.

The best lenders may additionally require you to have very good credit so you’re able to add more financial obligation into the financial. Speak to your financial towards options, allowing them to understand how much financial obligation you have. While having trouble conference the debt-to-income (DTI) ratio criteria, going the debt towards mortgage makes it possible to be considered with the household.

Might you Consolidate an auto loan Into your Home loan?

When i went along to get a house, among the https://elitecashadvance.com/payday-loans-ar/ items We ran towards the was that monthly car repayment put my personal DTI extraordinary to possess degree. In order to keep my DTI in line with underwriting standards, anything had to be done about the car repayment.

To create they functions, I funded most at home loan to settle the fresh car finance. My mothers provided something special to own the main downpayment, putting some bargain inexpensive. In order to have other people protection area of the off percentage, it must be a present – and usually off a family member.

The extra matter from the loan intended cash to settle the vehicle, reducing my total DTI, and that i were able to purchase the house.

Are you willing to Move Personal credit card debt Into the Home loan?

Like with other sorts of first time home consumer debt consolidation reduction, you can make use of your mortgage to repay the their personal credit card debt. not, you may want a larger down payment because of it to operate. In addition, brand new underwriters should cautiously check your payment records to be sure you have been consistent to make typical, on-go out money.

This may not be a knowledgeable suggestion, regardless if, since your credit debt is unsecured. If you skip payments, your creditors can be sue you and are different ways to get towards loans, but they can not seize your house. For folks who roll credit card debt with the a home loan, in the event, things changes. In the event the large commission is not possible, you now turned into you to definitely consumer debt to the secure loans and put your property on the line.

In some instances, for those who have sufficient more funds making more substantial down percentage, you happen to be will best off simply individually paying down their higher-focus credit debt unlike together with they along with your family financing.

To invest in a property While in financial trouble

Debt-to-money proportion might have been in the list above, and is for 1 decent cause: once you cam first-time domestic visitors debt consolidation reduction, this is the key to the new formula.

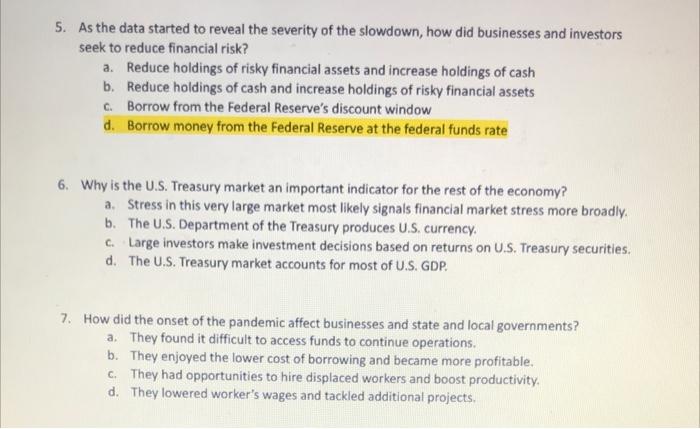

DTI means the degree of your own month-to-month money going into debt costs. Can you imagine you’ve got the after the monthly payments:

- Car loan An excellent: $350

- Car finance B: $2 hundred

- Mastercard The absolute minimum: $160

- Credit card B minimum: $105

- Charge card C minimum: $75

- Education loan A: $300

- Education loan B: $250

Every one of these repayments amount to $1,440 every month. Today, what if you make $4,200 per month. Their DTI is actually 34 % – and is in advance of your homes financial obligation is within the picture.

Of several normal home loan guidelines will let you keeps around 43 per cent DTI when buying a property, including your mortgage. Very, if you are looking during the home financing commission out of $700 thirty day period, that can force the total loans doing $dos,140, or 51 percent DTI. It will likely be difficult to qualify having people numbers.

When purchasing a house, you ought to figure out how to pay-off loans. Element of it can be using more substantial down payment in order to make room so you’re able to roll a few of the debt into the domestic financing, getting rid of that loan (and a fees).

To the right think, it’s possible to consolidate the debt before you make your home loan circulate. An important is in bringing a debt settlement loan that lowers their monthly installments which means that your DTI is acceptable to lenders.

Your huge loan provides all the way down payments because you rating a longer label. State your obtain $19,five hundred for 5 ages – sufficient to find yourself paying your autos and combine your borrowing from the bank card debt. Playing with a debt repayment calculator, you can see that you can cut $five-hundred 1 month.

Subtract you to definitely $five hundred regarding the $dos,140 you had been at ahead of, now your DTI is actually right down to 39%, which is on acceptable variety for almost all loan providers. If you can re-finance and you can combine your student education loans, you may be able to find one DTI actually lower.

Buying property immediately following debt consolidating means considered, regardless if. Your credit score might take a primary struck, so you may you would like a few months to recoup. Consider combining the debt at the very least 6 months before you apply to suit your mortgage. Try not to close your credit cards. Instead, place them out so you aren’t together and you will running them up once again. We want to keep good obligations usage get.

With a little considered, it’s possible to buy a home although you features loans. Work on the fresh numbers and find out when the consolidating can help you offer down your own DTI and then have into the earliest family.